-

Our planet, including our atmosphere, forests, water, and other living entities, are fundamental to human survival. Yet these services have been vastly undervalued and under-resourced. Studies estimate a US$900 billion gap in annual funding needed for conservation critical to maintaining biodiversity and climate outcomes. The field of conservation finance aims to address this massive financing gap as well as the multitude of ways global markets and policies shortchange nature. Conservation finance umbrellas a variety of concepts, including (but not limited to) payments for ecosystem services, nature-based solutions, and environmental markets. In this course, we will focus on key concepts, tools, and challenges in this space. The course will be multidisciplinary, much like the field itself, which reaches across the intersections of ecology, economics, policy, finance, and human rights.

KEY QUESTIONS

What is conservation finance and what is its role in biodiversity, water, and climate?

What are the range of existing finance strategies and tools?

What bottlenecks hold back conservation finance?

What are examples of conservation finance in the field?

How does policy drive or shape or omit conservation finance?

What are the different roles of public and private financing?

-

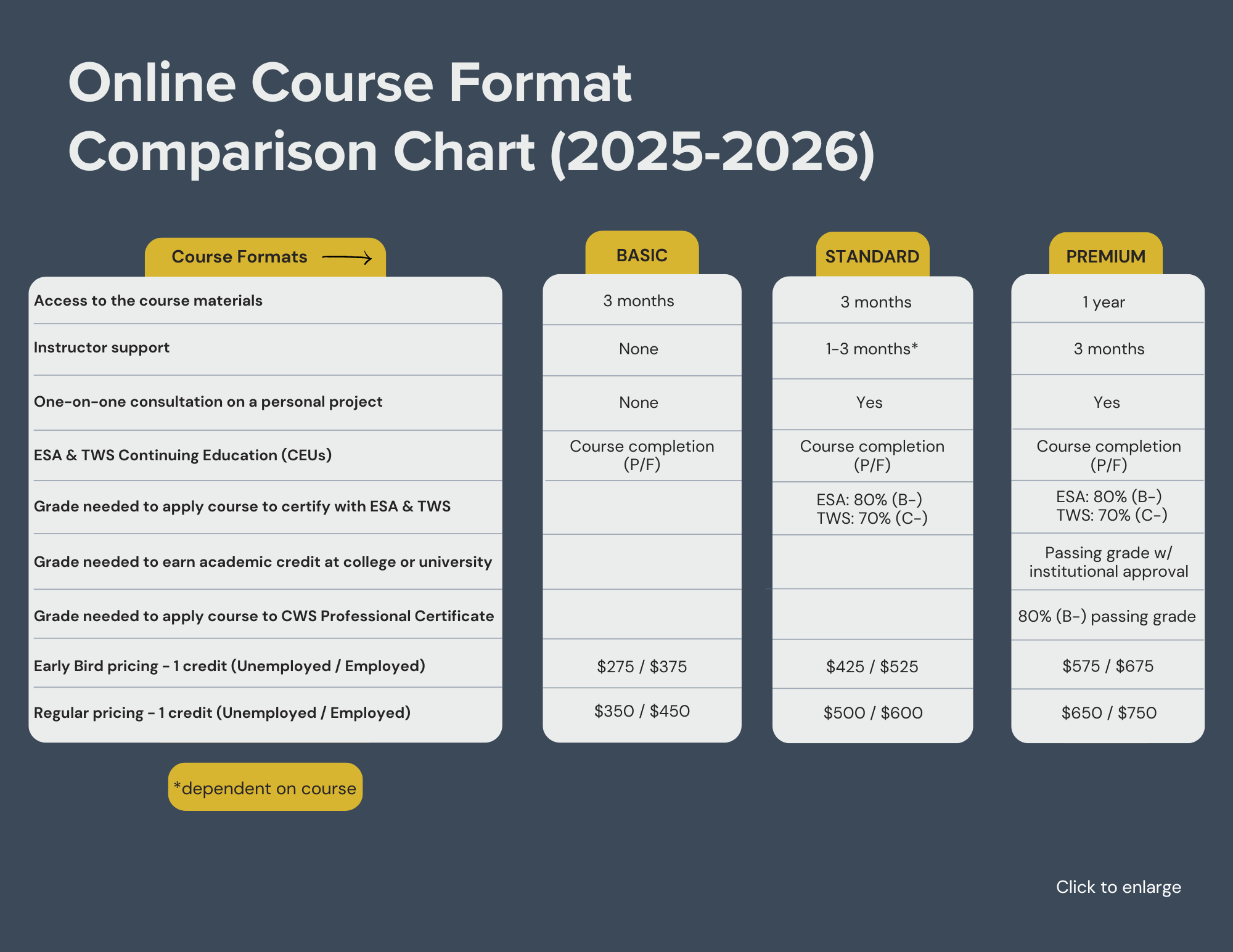

Learn at your your own pace with or without instructor support (see Online Course Format Chart below for details).

Spring: May 11 - August 2, 2026 (Early bird* ends April 12)

*Early bird saves $75

-

LEARNING OUTCOMES

Explain the similarities and differences of conservation finance tools.

Identify the different tools that might be viable given a conservation scenario.

Utilize metrics for evaluating the impact and success of different strategies.

Assess critiques and their strengths and weaknesses.

Identify areas where more funding, research, and policy are needed to support conservation finance efforts.

Build relationships with peers by working on group projects, participating in class and in online discussions.

Demonstrate and communicate a broad understanding of conservation finance.

COURSE OPTIONS & INFORMATION (Review chart above, then click below)

-

FORMAT:

3 months of access to course materials as you work at your own pace

CONTINUING EDUCATION:

16 CEUs with The Wildlife Society (go to our Continuing Education Page for more details)

-

FORMAT:

3 months of access to course materials

Get instructor support for the 3-month term via email, discussion threads, group meetings, and one-on-one appointments

After working through the course materials, set up an optional meeting with the instructor to discuss your own personal project from work or school

CONTINUING EDUCATION:

16 CEUs with The Wildlife Society (go to our Continuing Education Page for more details)

-

FORMAT:

12 months of access to course materials as you work at your own pace

Get instructor support for the 3-month term via email, discussion threads, group meetings, and one-on-one appointments

Receive Mentor Direct Constructive Feedback on your Capstone Project and a 1:1 Mentor-Mentee Session to refine your intervention plans and enhance your project's impact.

CONTINUING EDUCATION:

16 CEUs with The Wildlife Society (go to our Continuing Education Page for more details)

CERTIFICATIONS:

Earn 1 credit toward a professional certificate in Conservation Planning with CWS

ACADEMIC CREDIT:

Earn 1 academic credit (go to our Academic Credit Page for details)

Earn an additional 1-2 academic credits with an Applied Project

PRIMARY INSTRUCTOR

SCHOLARSHIPS

Full scholarships are available to participants from countries designated as “lower income” and “lower middle income” in the World Bank List of Economies. Please see our CWS World Scholars Program page for details.

CANCELLATION POLICY

Cancellations 30 days or more before the start date are not subject to cancellation fees. Cancellations <30 days before the start date are subject to a 50% cancellation fee. No refunds once the course begins.